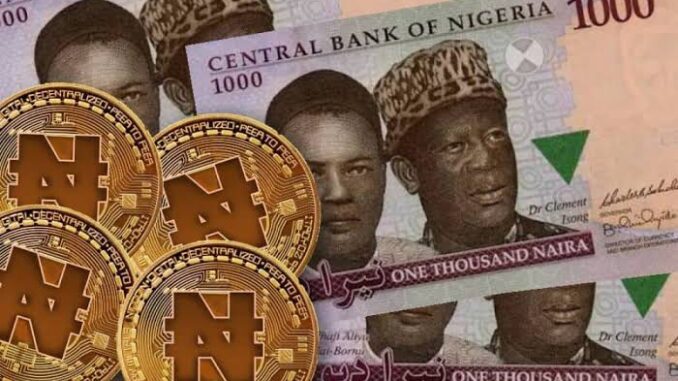

The Central Bank of Nigeria (CBN) has said that Nigeria will work with Bitt Inc as a technical partner in its bid to launch its own cryptocurrency, the eNaira.

The CBN announced the formal engagement of the global Fintech Company, Bitt Inc., as the technical partner for its digital currency, eNaira, on Monday.

the Central Bank Governor, Mr Godwin Emefiele, announced this in Abuja, after Mr Osita Nwanisobi, Director, Corporate Communications of the Bank, made it known in a statement on Monday in Lagos.

Emefiele has said the eNaira would operate as a wallet against which customers can hold existing funds in their bank account.

He said the apex bank’s selection of Bitt Inc. from among highly-competitive bidders is hinged on the company’s technological competence, efficiency, platform security, interoperability and implementation experience.

“In choosing Bitt Inc, the CBN relied on the company’s tested and proven digital currency experience, which is already in circulation in several Eastern Caribbean Countries.

ALSO READ: Osinbajo’s intervention working as CBN decides to launch own digital currency

“Bitt Inc. was key to the development and successful launch of the central bank’s digital currency (CBDC), pilot of the Eastern Caribbean Central Bank (ECCB), in April 2021,” he said.

Emefiele listed the benefits of the CBDC to include:Increased cross-border trade, accelerated financial inclusion, cheaper and faster remittance inflows.

Others are easier targeted social interventions, as well as improvements in monetary policy effectiveness, payment systems efficiency, and tax collection.

He added that the CBDC, known as “Project Giant”, had been a long and thorough process for the CBN, with the Bank’s decision to digitize the Naira in 2017, following extensive research and explorations.

“Given the significant explosion in the use of digital payments and the rise in the digital economy, the CBN’s decision follows an unmistakable global trend in which over 85 per cent of Central Banks are now considering adopting digital currencies in their countries,” he said.

Earlier, the CBN, had, announced plans to launch its own digital currency later this year after Nigeria barred banks and financial institutions from dealing in or facilitating transactions in cryptocurrencies in February. read more

Barbados-based Bitt earlier this year led development of the Eastern Caribbean Currency Union’s “DCash,” the first digital cash issued by a currency union central bank.

The Eastern Caribbean on Thursday became the first currency union central bank to issue digital cash, a move that comes as bigger monetary authorities such as the European Central Bank look at issuing their own electronic cash.

Official digital currencies are more “risk-free” than private electronic payment systems as they are backed by the central bank. They also cut out the middle man, reducing the cost of transactions, and make e-payments possible for those without bank accounts.

The so-called DCash is being initially rolled out in four of the eight member countries of the Eastern Caribbean Currency Union, according to Bitt, the Barbados-based firm that led its development. The pilot includes Antigua and Barbuda, Grenada, Saint Kitts and Nevis, and Saint Lucia. read more